aurora sales tax rate 2021

The average sales tax rate in Colorado is 6078. You can print a 85 sales tax table here.

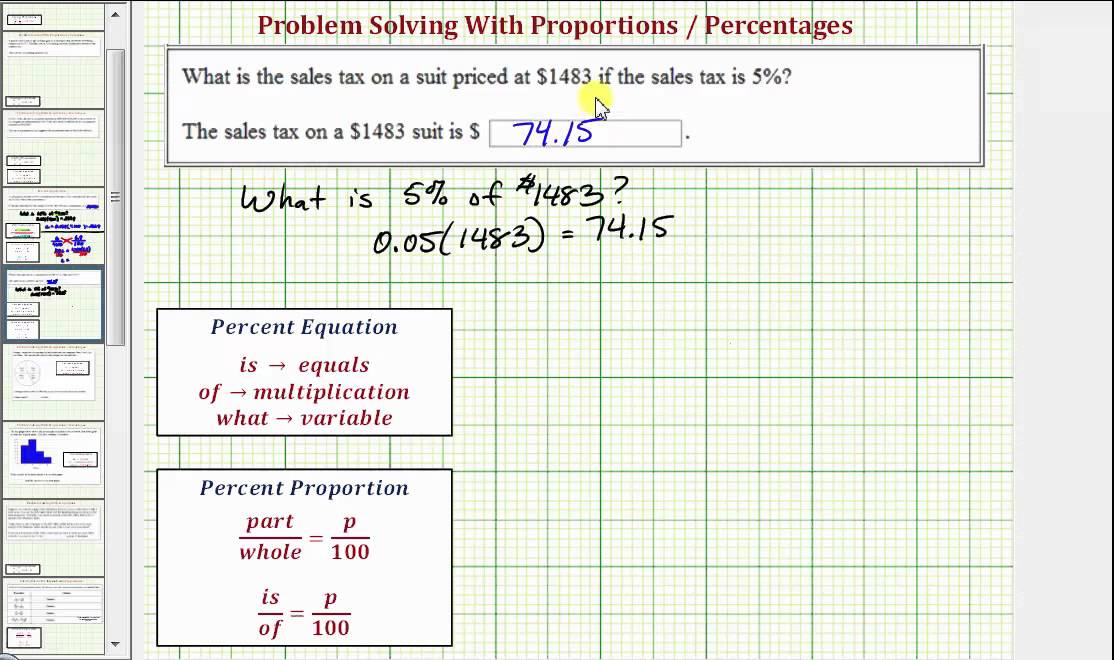

Solving Sales Tax Applications Prealgebra

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

. The minimum combined 2022 sales tax rate for Aurora Minnesota is. The Aurora sales tax rate is. This Part 1 outlines criteria for determining.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Aurora-RTD 290 100 010 025 375. The Aurora Sales Tax is collected by the merchant on all qualifying sales.

The County sales tax rate is. Did South Dakota v. 44 E Downer Place Aurora IL 60505.

Colorado sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. And Seattle Washingtonare tied for the second highest rate of 1025 percent. Wayfair Inc affect Minnesota.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. This is notan all inclusive list. Real Estate Transfer Tax Line.

1 Outside Business District 850 825 025 No. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. There is no applicable special tax.

The Nebraska state sales and use tax rate is 55 055. Sales Tax Rate Changes for Sales of General Merchandise Jurisdiction Combined rate ending December 31 2021 Rate Change NEW Combined rate beginning January 1 2022 Type of. 5 Food for home consumption.

Did South Dakota v. Retail Sales 2 Revised August 2021 Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations. 4 Sales tax on food liquor for immediate consumption.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Friday January 01 2021. Aurora Sales Tax Rates for 2022.

This clarification is effective on June 1 2021. The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

Macy S Black Friday Ad Flyer 2021 Jcdavila Com My Weekly Ad Journals In Us United States Black Friday Rugs Macys Black Friday Black Friday Ads. The December 2020 total local sales tax rate was also 8000. Austinburg 44010 Ashtabula 675.

Local tax rates in Colorado range from 0 to 83 making the sales tax range in Colorado 29 to 112. 24 lower than the maximum sales tax in CO. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Aurora CO is 8000. City Final Tax Rate. 775 775 100 No change 875 775 Business District Aurora DuPage County Aurora Business District No.

The Minnesota sales tax rate is currently. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. 3 Cap of 200 per month on service fee.

Birmingham Alabama at 10 percent rounds out the list of. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. For tax rates in other cities see Missouri sales taxes by city and county.

Note that failure to. Ad Apply For Your Colorado Sales Tax License. POST OFFICE ZIP CODE COUNTY RATE POST OFFICE ZIP CODE COUNTY RATE PAGE 2 REVISED January 1 2021 Dennison 44621.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Aurora property tax rates are the 9th lowest property tax rates in Ontario for municipalities with a population greater than 10K. Ad Lookup Sales Tax Rates For Free.

For tax rates in other cities see Colorado sales taxes by city and county. Best 5-Year Variable Mortgage Rates in Canada. 2021 Tax rates for Cities Near Aurora.

Wayfair Inc affect Colorado. The minimum combined 2022 sales tax rate for Aurora Colorado is. Annual - Taxes due of 100 or less per year Reporting.

The December 2020 total local sales tax rate was also 8250. What is the sales tax rate in Aurora Colorado. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent.

You can print a 9225 sales tax table here. The City of Auroras tax rate is 8850 and is broken down as follows. The minimum combined 2022 sales tax rate for Aurora Colorado is.

The current total local sales tax rate in Aurora IL is 8250. The Colorado sales tax rate is currently. The County sales tax rate is.

Method to calculate Avondale sales tax in 2021. Aurora 44202 Portage 700. Wholesale sales are not subject to sales tax.

Wednesday July 01 2020. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Five other citiesFremont Los Angeles and Oakland California.

0375 lower than the maximum sales tax in MO. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected.

Find your Colorado combined state and local tax rate. This is the total of state county and city sales tax rates. Effective December 31 2011 the Football District salesuse tax.

What is the sales tax rate in Aurora Minnesota. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. The Aurora Illinois sales tax is 625 the same as the Illinois state sales tax.

The base state sales tax rate in Colorado is 29. City of Aurora 250. The Aurora sales tax rate is.

Interactive Tax Map Unlimited Use. Note that the State of Colorado has enacted the same clarification.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Calculate Cannabis Taxes At Your Dispensary

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Solving Sales Tax Applications Prealgebra

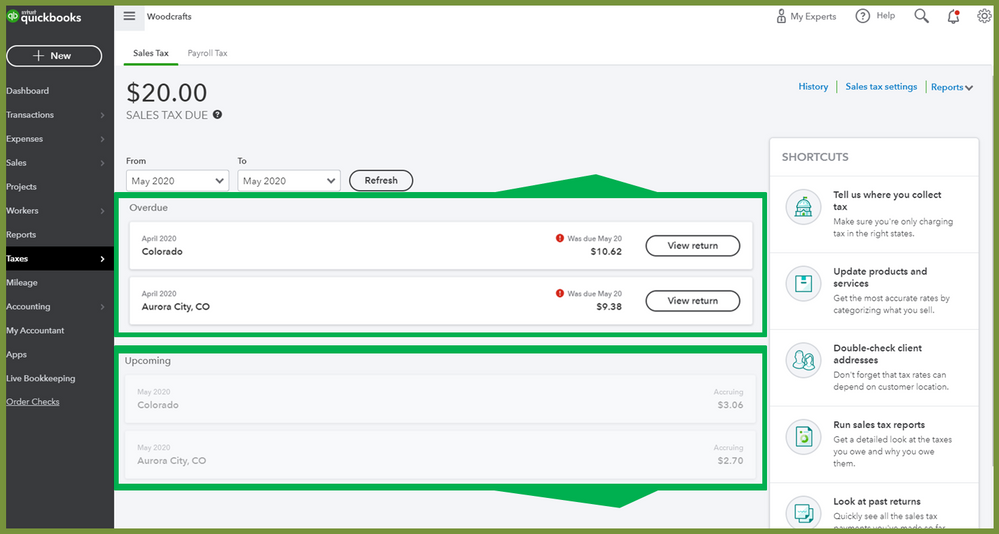

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Solving Sales Tax Applications Prealgebra

Set Up Automated Sales Tax Center

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Solving Sales Tax Applications Prealgebra

Colorado Sales Tax Rates By City County 2022